Track short term trades three times a week with our research report “Trading Opportunity with TheTape” This also includes a subscription to our weekly newsletter focused on “Portfolio Design with TheTape” for longer term investors.

Both newsletters come with access to a suite of reports at TheTape.Report. Learn how to analyze opportunity through the lens of liquidity and spreads with our Real Time Research, and bolster your own trading with in depth analytics.

Every report comes with a seven day free trial. Find out more on our website today.

Setting the Table:

Equity markets had their biggest positive day since June as light volume and buoyant spirits lifted the tape. In one of those confusing ex-post justifications for a move, the market liked weaker jobs data as it potentially signals rates coming in faster. With mixed signals either way, you can almost argue the Fed has found a sweet spot here. It’s only a successful negotiation if everyone feels like they lost.

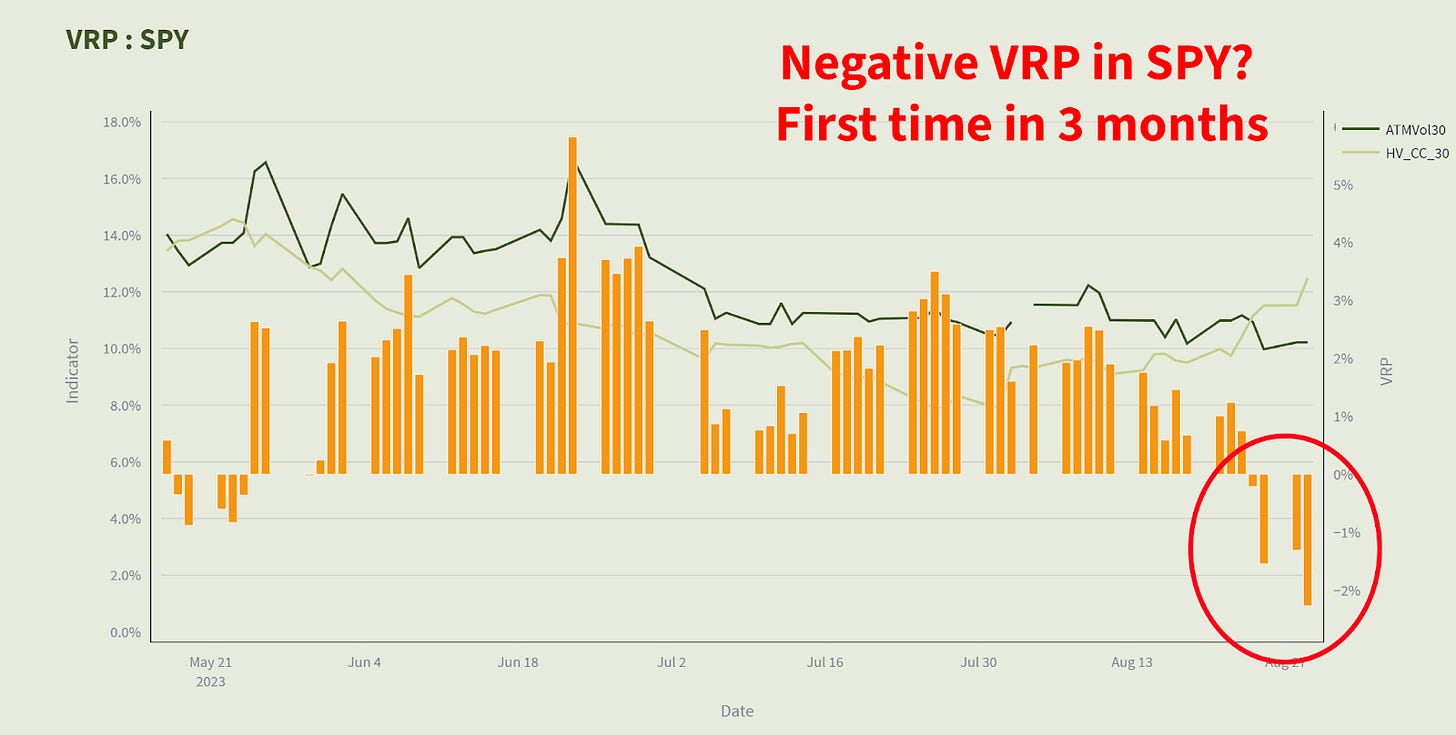

We’ve been talking about the relationship between implied and realized volatility, and with some chop both ways over the last week, that’s been 4 consecutive days of negative VRP at the 30 day level. Vol has again drifted down with ATM SPY 30 days out only trading around 12%, but with little on the calendar in the next month that’s not surprising. Dealers and pricers of volatility believe despite what’s (not) happened the last few days, there’s less on the horizon.

In an important win for digital assets, Grayscale won its lawsuit against the SEC in a bid to convert their Bitcoin trust into an ETF. This opens the door for many other applications, and is a major win for participants in the trust, who saw their discount to NAV (e.g. BTC holdings) drop to as low as 50%. Crypto investors have long found an enemy in Gary Gensler for his arbitrary and enforcement driven regulation of the industry, and this is a significant moral victory. The discount that existed on the trust was one of the most popular levered crypto trades in 2021, and one of the trades that helped to blow out 3 Arrows Capital.

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products,” Circuit Judge Neomi Rao wrote.

See Also: “What Grayscale’s win means for the SEC and the future of bitcoin ETFs”

Identify:

With markets rising throughout the summer and even the specter of transactions on the horizon, it’s only the fin bearing sharks that are keeping bankers from the beach this summer. If there’s one dealmaker and DJ that isn’t partying, it’s David Solomon at Goldman Sachs. He’s been hounded by negative press takes over the summer, with salacious rumors leaking amidst general grumblings by the typically white shoed and purse lipped partners.

Mark Rubenstein over at Bloomberg has an in-depth look at the history of the firm and how they’ve handled controversy and power struggles in the past. (He’s also the author of the great blog “Net Interest”).

Recently, Solomon has been focused on centering the business around its traditional profit centers of trading and investment banking. Expansions into financial advisory and even consumer finance (Marcus) have been flops for a firm that’s used to being #1.

On Monday, GS announced that it would be divesting its PFM unit in a sale to Creative Planning - the VC funded RIA behemoth. This unit was only acquired in 2019 at a cost of $750M, and though the terms were not disclosed, they did claim a gain. Creative Planning has been aggressively gathering assets of the past few years in an attempt to scale client relationships. They now have over $240B in assets.

In addition to getting rid of these $29B in high net worth client assets, the firm is also actively seeking bidders for its consumer lending unit “Green Sky”. The market liked this news with a 1.8% rally in the stock yesterday (banks overall were up 1.1% via XLF, and the SPX was up 1.4%). However the firm is still down 5% on the year, zagging the opposite way of the market.

LIQ was about 170% over average yesterday with this news, as volume picked up and began speculating about the implications for Goldman realizing its refocus.

Keep reading with a 7-day free trial

Subscribe to Trading Opportunity with TheTape to keep reading this post and get 7 days of free access to the full post archives.