Is Profitability Beyond Reach?

Can the fake meat producer $BYND tighten its belt amidst cost and health concerns?

Setting the Table:

Yesterday’s session was relatively calm with most of the earnings news out of the way. SPX pinned back around the 4500 level, though they look to be paring most of their gains this morning. Moody’s lowered ratings for ten regional banks and China signaled weaker trade, both arguably sparking the sell off. To me this just feels like wishy/washy summer trading.

Options markets volume was lighter yesterday, trading only 38M, about 12% below YTD average. Liquidity has stayed fairly steady for top indices, even as volume has dropped. This is mostly attributed to tighter and tighter markets as SPY notched a top ten tightest day of the past year.

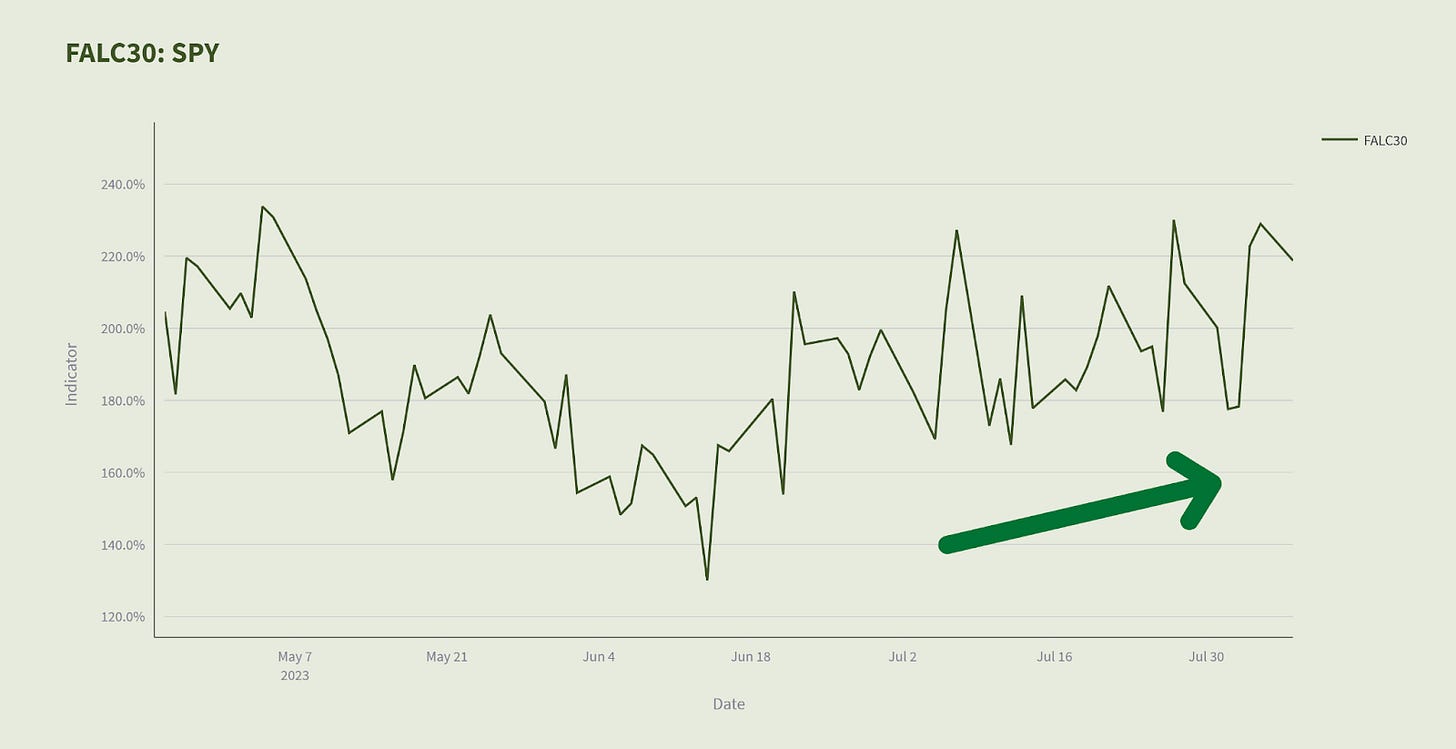

Skew however, has creeped up as the market is settling in this range. Even the bulls are surprised at the speed at which the market has climbed a wall of worry, and put buyers are starting to come out. FALC30 measures the 15 delta risk reversal 30 days out, and $SPY puts now over two times as expensive as calls at that tenor and range (>200%).

The United States is back on the government shutdown carousel, as lawmakers left for their August break without resolving a number of remaining spending issues. With a Fitch downgrade already in place, September sessions could heat up and also further complicate Fed action.

Keep reading with a 7-day free trial

Subscribe to Trading Opportunity with TheTape to keep reading this post and get 7 days of free access to the full post archives.