Setting the Table:

Last week was finally a win for the bears crowing over-valuation as the broad indices slid over 2%. Futures are lightly green headed into today’s session as most companies have reported earnings - with over 80% beating expectations.

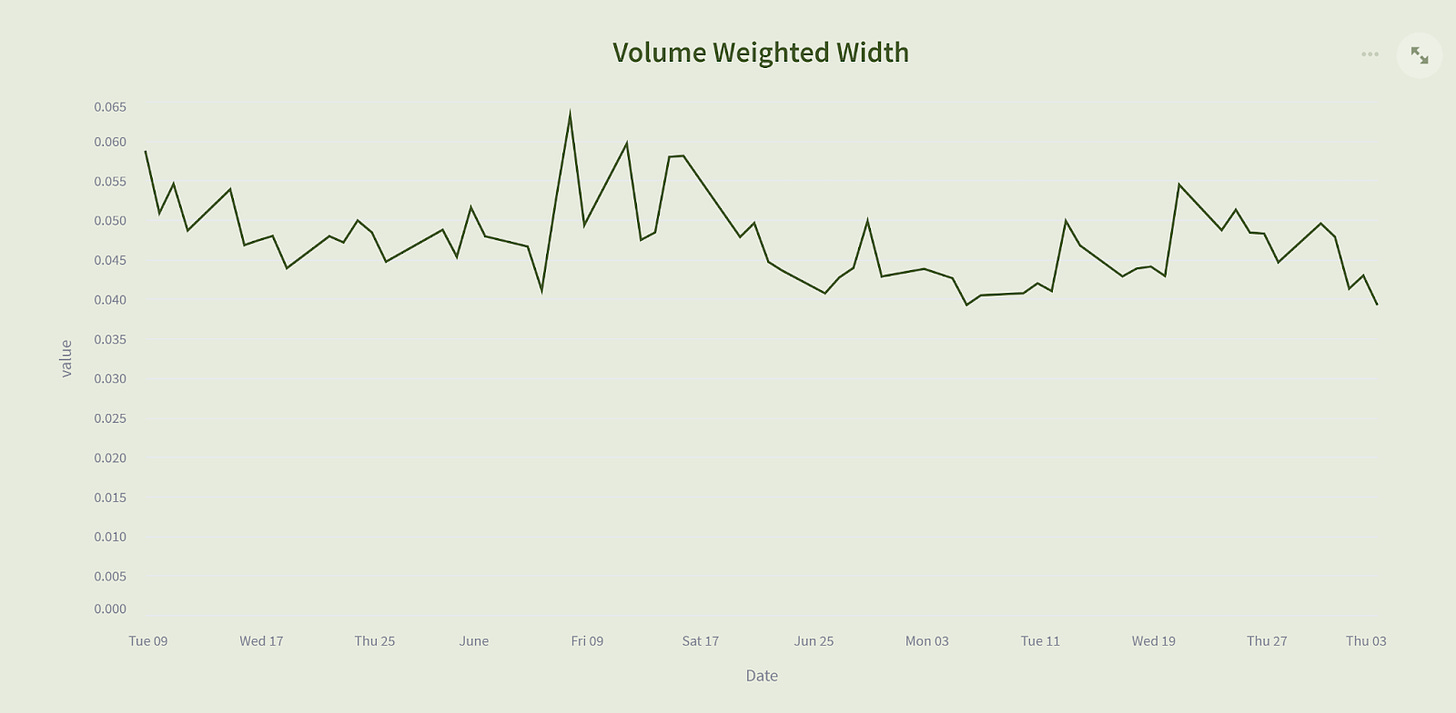

Volume Weighted Width measures the average spread in options series traded, weighted by volume. As liquidity grows, this metric has shown a continued and steady decline. More activity has brought tighter spreads - OCC volume topped 55M Friday, and August is already 6% the YTD average. Since the beginning of May, across all names the average spread has gone from 6% points to only 3.9% today. (e.g. a bid/offer spread of 40% at 43.9%.

Are meme stocks back? Some of the most popular names over the past week were $YELL, $RAD, and $TUP. $TUP catapulted into the Top 250 last week and we dig into their debt restructuring plan below. $YELL (trucking business Yellow) and $RAD (Rite Aid pharmacies) don’t quite make the cut, and are below our liquidity threshold. While there might be interesting opportunities, note that markets are very thin and inputs are likely to change fast.

Keep reading with a 7-day free trial

Subscribe to Trading Opportunity with TheTape to keep reading this post and get 7 days of free access to the full post archives.