Setting the Table:

Markets were quiet yesterday with the S&P 500 not even moving double digits. The rumbling of $100 oil is back with Brent tipping over $95/barrel and increasing fears of price driven inflation.

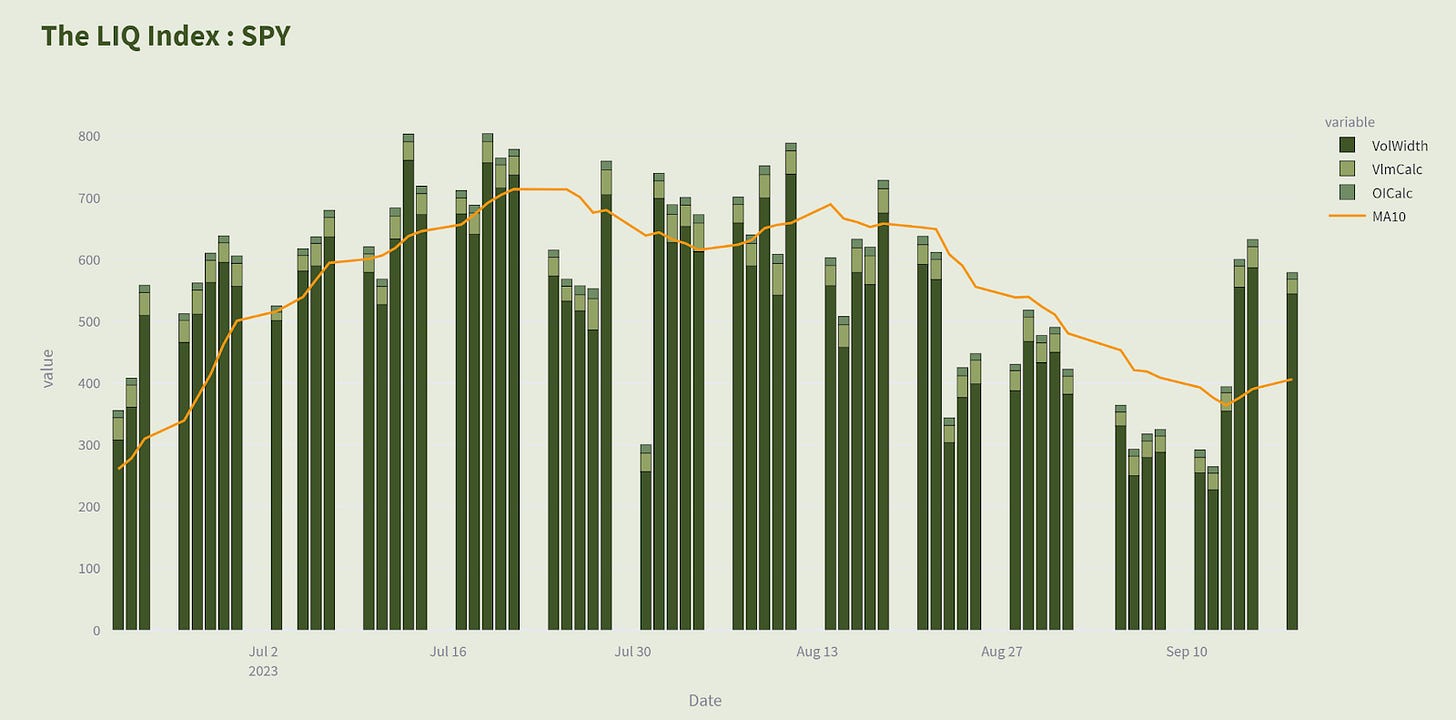

Options markets equally so, with a bottom decile reading of only 34m contracts. Risk off until Jerome says anything. LIQ stayed stable despite the low activity, as spreads were more certain than last week.

More 0DTE focus from Bloomberg, as they highlight the convexity potential of these bets. The notional exposure from a 0DTE option on a dollar cost basis will be cheaper than any other one - that’s obvious and part of the options pricing model. Fortunately the takes are nuanced, as they quote several others suggesting fears here are overblow.

Hot off the presses is a leadership transition at CBOE. Ed Tilly will be stepping down from his role as CEO and Chairmen following an internal investigation by the Board. He’s replaced by former top TD exec and CBOE board member Fredric Tomczyk. Ed’s been a major force behind important acquisitions, product launches, and strategic development. The next steps will be interesting.

Identify:

In a quiet tape, there aren’t necessarily many names making higher highs. Day over day we only saw two names that more than doubled the average LIQ, when normally it’s 25 +. One of those was Unity Software (U) which has been chopping around trying to identify the appropriate pricing strategy for its software.

It’s been a wild ride since the IPO in late 2021. After riding the market cycles through 2022, it’s fallen off over 80% from the highs almost two years ago.

On a more local scale, we’re down 33% from the highs in mid July.

And in just the last week, the company has been working to turn that around. The stock has been crashing as revenue numbers have flagged, which come primarily from subscription fees. Increasing those however, has angered its core community, and caused them to do a 180 degree turn yesterday. Stock fell another 7.90%.

A crashing growth rate has been part of the problem. Revenue grew by 25% in 2022, down from 44% growth in 2021, and the situation has gotten worse this year. Revenue edged up 2% in the first quarter and 11% in the second quarter. These growth rates are on a pro forma basis to account for the acquisition of ironSource.

Unity relies on subscription fees for a big chunk of its revenue. The company's Create Solutions segment, which covers subscriptions, support, and professional services, accounted for a bit more than half of total revenue in 2022. For anyone not a student or hobbyist, Unity charges hefty per-seat fees for using its platform. The company boosted some of these fees last year, which helped keep revenue growing.

A price increase for serious game developers already paying hundreds of dollars per month per seat isn't going to dissuade anyone from using Unity, but the company's latest change might. In addition to some other changes, Unity will begin charging a per-install "Runtime Fee" in 2024 on top of its subscription fees.

LIQ has not just seen a one day bump from this tumult, but a continued increase over the past week. Spreads have remained steady while volume picks up.

Keep reading with a 7-day free trial

Subscribe to Trading Opportunity with TheTape to keep reading this post and get 7 days of free access to the full post archives.